Farmer protest: What you need to know about the tractors in Whitehall

| Updated:

Farmers have filled the streets in Whitehall to protest the Labour government’s budget plan to introduce inheritance tax on some farmland.

Listen to this article

Read time: 5 mins

In brief…

- From 2026, farmers will be asked to pay 20% of anything inherited valued over £1m – half the usual rate of inheritance tax.

- Labour has said this is part of its attempts to plug the £22 billion deficit inherited from the previous Conservative government.

- The Tories have said asking owners of farmland with million-pound assets to pay tax is “cruel”.

What’s the story?

The streets of Whitehall in central London usually echo to the sounds of black cabs and commuters in their cars unbothered by paying congestion tax to travel to work.

On Tuesday 19 November, those streets were instead shaken by the rumble of tractors headed for Downing Street as farmers protested a change in inheritance tax laws specifically targeting UK owners of farmland.

The change was announced in Labour’s recent budget.

From April 2026, anyone inheriting agricultural assets worth over £1 million will have to pay 20% tax on its value, interest free over a ten-year period

This is half of the inheritance tax rate for everyone else in the UK, where inherited assets over £325,000 are taxed at 40%.

“We don't have many farmers in this country, really, in the grand scheme of things,” says Lewis Goodall, from the protest in Whitehall.

“For many decades, farmers have more or less been exempt from inheritance tax duties, because the argument has been that farming often isn't that profitable, and if you subject them to inheritance tax, it might break up family farms.”

Signs at the protest featured slogans such as “British food – choose it or lose it” and “Stop killing the people who feed you”.

A 2023 report revealed that a third of UK farmland is owned by the aristocracy. The second biggest owner is large corporations, who make investments for tax-saving opportunities. Tycoons and the public sector are also major owners of huge areas across the UK.

Farmers' protest: This is the final straw

What's been said about the introduction of the inheritance tax?

The National Farmers’ Union (NFU) has called for the government to scrap the changes, claiming that while value of property may be high, income made from selling produce is often "very low".

"Clearly the government does not understand that family farms are not only small farms, and that just because a farm is an asset, it doesn’t mean those who work it are wealthy," says NFU president Tom Bradshaw.

"Every penny the Chancellor saves from this will come directly from the next generation having to break up their family farm. It simply mustn’t happen."

Environment Secretary Steve Reed has said that introducing inheritance tax for farmers is part of Labour’s attempts to plug the £22 billion deficit inherited from the previous government. He told the BBC that inheritance tax contributions from farmers is part of a “fair and proportionate” way to stabilise the UK economy.

"It's only right to ask the very wealthiest farmers and those wealthy individuals who have been buying up agricultural land to avoid their own inheritance tax liability to pay their fair share," he said.

A joint statement from Reed and Chancellor Rachel Reeves stressed that the Labour government has a "steadfast" commitment to UK farming, and will invest £5 billion into the industry over the next two years.

Kemi Badenoch, leader of the Conservatives, has said that a “cruel” 20% inheritance tax threatens the UK's entire agriculture system.

"This callous decision threatens everything from our rural economy to our food security to our natural environment," she says.

Billionaire James Dyson, who is believed to own 36,000 acres of farmland in the UK, has been a vocal opponent of the government's plans, calling chancellor Rachel Reeves' budget "spiteful".

TV presenter Jeremy Clarkson, who has also spoken out against the tax and was among London protesters, owns 1,000 acres of farmland.

What's The News Agents' take?

Jon Sopel and Lewis Goodall headed to the protest, in the November sleet, to speak with farmers protesting the government's tax plans.

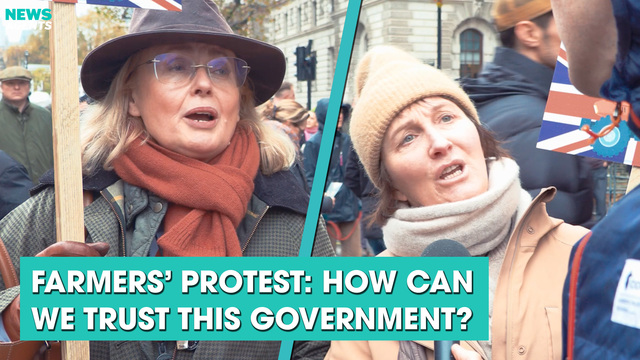

Farmers' protest: How can we trust this government?

Jon says farmers are worried Rachel Reeves' tax plans would see them "clobbered" when the time comes to pass their farm onto their children.

"The family won't be able to be able to pass it on to the next generation, as has been the tradition in British farming, because the inheritance tax bill will be so large," he says.

But existing allowances for farmers wanting to pass their property on means that many landowners will be able to pass land and property worth up to £3m without paying a penny of inheritance tax.

The government says Labour’s inheritance tax changes will only affect around 500 farms in the UK, but this number is disputed by the NFU.

"There is a kind of emotional, cultural value and attachment and feeling, a sentiment around farming that doesn't exist with other industries," says Lewis.

"We hear this phrase in this debate around the family farm, about it being a backbone of the country in all sorts of ways, and how important it is. So that has emotional resonance for people."

He says that the perception of farming, for many people, has been changed by Jeremy Clarkson's TV show, which has shown viewers the grim reality of trying to run a successful agriculture business.

Jon and Lewis also say that there were signs at the protest supporting conspiracy theories about Net Zero and anti-vaxx, along with signs in support of Reform UK.

"You've got a traditional kind of anti-Labour feeling in rural areas, they feel that Labour just doesn't get the countryside,” Lewis says.

“There are about 100 Labour constituencies now with rural or farming communities – so that's not entirely true.

“You've also got that online discontent, which is being fueled by the right and I think it's no surprise you're seeing a huge number of Reform-minded people here.”

He also adds that 53% of British farmers voted for Brexit – despite it resulting in them losing subsidies paid to farmers in the EU.

"When we were in the European Union farmers had this wonderful feather bedding called the Common Agricultural Policy. It gave them the subsidies that are now being phased out," Lewis adds.

"A number of farmers have been honest enough here today to say, 'look, the change to inheritance tax is the straw that broke the camel's back'."